A get-rich-quick scheme is currently trending in Nigeria, a country where a significant percentage of the population lives in abject poverty. While it may appear to be a quick way out of financial hardship, it often leads to a darker path — a way into debt, setbacks, regrets, and depression.

You Think Say You Don See Awoof Money? Dey Play!

Chima, a 25-year-old, lives in Lagos. As it’s typical of every unemployed graduates, he’d tap his phone, scroll through the internet, searching for opportunities. For months, he’s been bombarded by posts and messages promising easy wealth—a chance to escape the grip of unemployment and poverty. As the economic climate in Nigeria continues to tighten, especially for young people, the lure of a fast track to success has never seemed more appealing.

“I’ve been done with NYSC (National Youth Service Corps) for over one year,” Chima admits, his voice a mix of frustration and desperation. “The pressure is mounting. Everyone is talking about these investments, people I know, people I trust, and they’re making so much money. I thought, why not take a chance? Maybe this is the way out.”

Chima, like thousands of Nigerian youths, has fallen into the trap of a Ponzi scheme—a fraudulent investment operation where returns are paid to earlier investors using the capital of newer investors. It’s a cycle of deception that promises quick returns but inevitably collapses, leaving many broke, disillusioned, and, in some cases, emotionally shattered.

But Chima’s story is not a unique case. Across Nigeria, Ponzi schemes have proliferated, fueled by the desperation of youths seeking to secure their financial futures in an economy that offers few opportunities. The question remains: Why are so many young people falling for these schemes? What drives them to risk it all for the promise of quick, easy wealth?

The Allure of Wealth: All That Glitters Dey Blind Eyes

The dream of financial freedom is universal, but for many Nigerian youths, the reality is much grimmer. Unemployment rates in Nigeria have reached staggering heights—40% of the workforce, according to official statistics. For young people, especially those between the ages of 18 and 35, finding stable work is an increasingly distant prospect.

With a population of over 200 million, Nigeria has a thriving digital landscape, and for many young Nigerians, social media is a window to the world. Platforms like Instagram, WhatsApp, and X are not only spaces for social interaction but also the marketplace for a new kind of economy—the “get-rich-quick” economy.

“Everyone is promoting these ‘investment opportunities,’” says Mariam, a 29-year-old fashion designer from Ibadan. “At first, I didn’t understand how it worked, but when I saw my friends posting about how they doubled their money in a week, I thought, ‘What’s the harm in trying?’”

Mariam’s story is typical of many. The rise of Ponzi schemes in Nigeria is largely driven by the relentless promotion of get-rich-quick schemes, many of which are marketed as “business opportunities” or “investment platforms” offering extraordinary returns. Whether through flashy adverts on Instagram or WhatsApp broadcasts, these schemes often prey on the hopes and insecurities of young people.

The marketing is slick. Testimonials from influencers, friends, and even family members often depict incredible success stories—promises of monthly returns as high as 50% or more. For young people like Mariam, the lines between legitimate investments and fraudulent schemes become blurred. After all, everyone they know is talking about it. But behind the glitzy facade lies a devastating reality.

The Proliferation of Ponzi Schemes: Wetin Carry Us Reach Here Self?

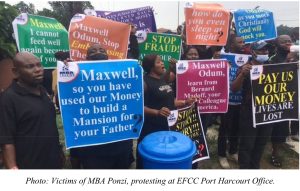

Ponzi schemes, which are named after Charles Ponzi—an infamous fraudster from the early 20th century—have seen a massive resurgence in Nigeria, particularly among the youth. Schemes like CoinTrove, MMM Nigeria and Cbex have left millions of people in financial ruin, yet each time a scheme collapses, another emerges. The latest Ponzi scams often disguise themselves with new names, sophisticated websites, and claims of “legitimacy,” making it difficult for many to differentiate them from genuine investment opportunities.

One of the reasons these schemes thrive is the lack of financial literacy among the Nigerian population, particularly among young people. In a country where many are unfamiliar with the basic principles of investing and saving, the allure of quick wealth becomes irresistible. Chima’s investment was made based on the assurance from a friend who had been paid his returns on time. “I trusted him,” Chima recalls. “He said the platform was good, and I saw him cashing out. So, I thought it would work for me too.”

However, within a few weeks, the payments stopped coming. Chima’s initial skepticism was replaced with disbelief as the platform he had invested in vanished. He tried reaching out to customer support, but the phone lines were disconnected, and the website went offline. By then, it was too late—his N50,000 was gone.

Across the country, young Nigerians are falling victim to similar schemes. For some, the losses are just a few thousand naira, while others lose their life savings. But the damage is far more than financial—it’s psychological. Many young people who lose their money become distrustful of the financial system altogether, leading them to feel alienated and hopeless.

The Hidden Cost: Dem No Dey Tell Person

The impact of Ponzi schemes extends far beyond the immediate financial losses. Victims often experience significant emotional and psychological distress, from guilt and shame to feelings of betrayal. For some, these schemes have ruined relationships, leaving them feeling embarrassed to face their families or friends.

“I couldn’t even tell my parents,” Chima admits, his voice faltering. “I knew they would be disappointed. I didn’t want to be seen as foolish. The shame was unbearable.”

Mariam shares similar feelings. “I didn’t want anyone to know. I was so sure it would work out, but when it crashed, I felt so lost. I’d promised my family that I’d finally be able to help with bills and make a name for myself, but instead, I lost it all. It crushed me.”

The personal toll is felt not only in individual lives but also in the broader social fabric. As Ponzi schemes continue to thrive, they perpetuate distrust in legitimate financial institutions. Nigerians begin to associate all forms of investment with deceit and fraud, undermining confidence in the financial system and in the government’s ability to regulate it.

Breaking the Cycle: Shine Your Eyes

The key to breaking the cycle of Ponzi schemes lies in education. Financial literacy is essential, especially in a country where the vast majority of people lack the tools to make informed financial decisions. Thankfully, some organizations are stepping up to provide the education and support needed to help young Nigerians make better choices.

Programs like Financial Literacy and Education for Nigerians (FLEN) are working with schools, universities, and youth organizations to equip young people with the knowledge to recognize scams and make sound financial decisions.

“We focus on equipping the youth with the tools they need to succeed in the financial world—tools that will help them distinguish between legitimate investment opportunities and fraud,” says Adaora Okeke, a financial literacy coach with FLEN. “It’s about giving them the knowledge and the confidence to take control of their financial futures.”

Alongside educational initiatives, there’s also a growing movement toward providing alternative pathways to financial security for young Nigerians. Entrepreneurs like Chijioke Nwosu, who founded Kickstart Nigeria, a social enterprise aimed at supporting youth entrepreneurship, are creating platforms that allow young people to build legitimate businesses. “The youth need opportunities, not illusions,” says Nwosu. “We need to shift the focus from quick fixes to building real, sustainable businesses.”

Micro-lending platforms and tech startups are also offering young people access to small, low-risk investments. These alternative routes allow Nigerians to invest their money in ways that are transparent and safe—something that many have never considered due to the overwhelming presence of scams.

While the proliferation of Ponzi schemes among Nigerian youth is concerning, it’s not an insurmountable problem. Through financial education, transparency, and the creation of legitimate economic opportunities, Nigeria’s youths can be empowered to make wiser financial choices.

Chima and Mariam’s stories are just two of many, but their lessons are universal. “I want to help others avoid the pain I went through,” Chima says. “No one should have to go through this. If I knew better, I wouldn’t have invested in that scheme.”

The future of Nigeria’s youth doesn’t have to be defined by fraud and deception. With greater awareness, better education, and real opportunities to build wealth, young Nigerians can escape the cycle of Ponzi schemes and chart a path toward true financial success.

437 total views, 4 views today